Search network campaigns? Certainly more conversions!

- Bluerank & ING Bank Śląski

In a project carried out in 2022 for ING Bank Slaski, we achieved above-average increases in the number of conversions. Below are the most important factors that we believe determined the success of Bluerank's Google Ads campaigns in the search network. Find out how we combined empathetic advertising communication with a series of optimisation measures.

Project team

Implementation of the described campaign by the Bluerank team: Emilia Pakulska (Senior PPC Specialist), Zuzanna Maciejewska (PPC Specialist), Aleksandra Majas (Account Manager).

Challenges

The economic and business aspect

As a neighbouring country to Ukraine, Poland was strongly affected by the war through rising inflation and the cost of living. Through rising credit costs (APRC 5.40% January, 8.42% December) and the declining creditworthiness of Poles, mortgage sales were threatened.

First party data

Making the process more structured on the banking side. As part of remarketing and to exclude audiences in campaigns, we started to use the data made available to us by ING Bank Slaski through the DMP platform. The correct preparation and use of first-party data is a challenge faced by digitally mature brands.

Range of activities

Although only a 'slice' of the activities carried out for the Bank came under the care of our campaign (search network campaigns only), the spread of activities was huge. The scope of the promotion included 8 separate banking products and over 1,000 active keywords. Each product was covered by different objectives, KPIs and required a separate advertising strategy.

Strategy and implementation

The main aim of the project was to increase conversions on all of the 8 banking products promoted. The strategy in 2022 aimed to improve specific advertising metrics, through the basic ones: an increase in website traffic volume (views, clicks, CTR), as well as more advanced ones: campaign cost optimisation (CPA, CPC), and an increase in the probability of conversion, which was difficult to achieve while increasing traffic volume (CR).

The target group for the project was all search engine users actively searching for a particular banking product. Their prioritisation and separate communication was applied according to the following breakdown (0 - exclusion from targeting, 1 - lower priority, 2 - higher priority). The type of search terms was divided according to:

A stage in the customer journey:

- very general, unspecific needs, e.g. "how to start a business" (SEE ↠THINK stage)

- general but already specified needs, e.g. "business account", "ranking of business accounts" (THINK↠DO stage)

- detailed, well-defined needs, e.g. "company account for a company" (THINK ↠DO stage)

- branded ↠ strongly specified needs, e.g. 'ING corporate account' (DO stage)

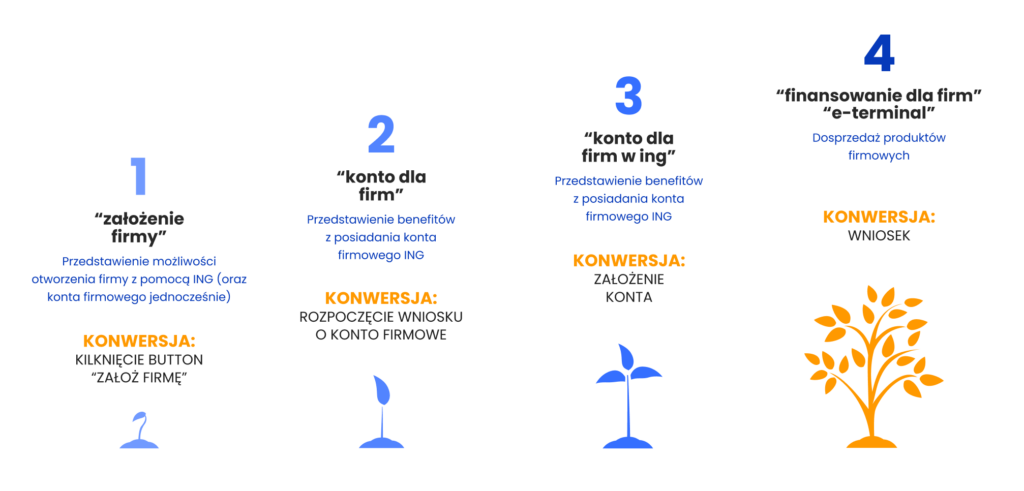

The presence of text adverts at each stage along the conversion pathway was important, and to make individual campaigns easier to recognise, different targets were used for each stage. Below is an example of the chosen keyword strategy for the konto Direct dla firm(Direct business account) product:

Legal status:

- B2B >> JDG / companies

- B2C >> age / parental status

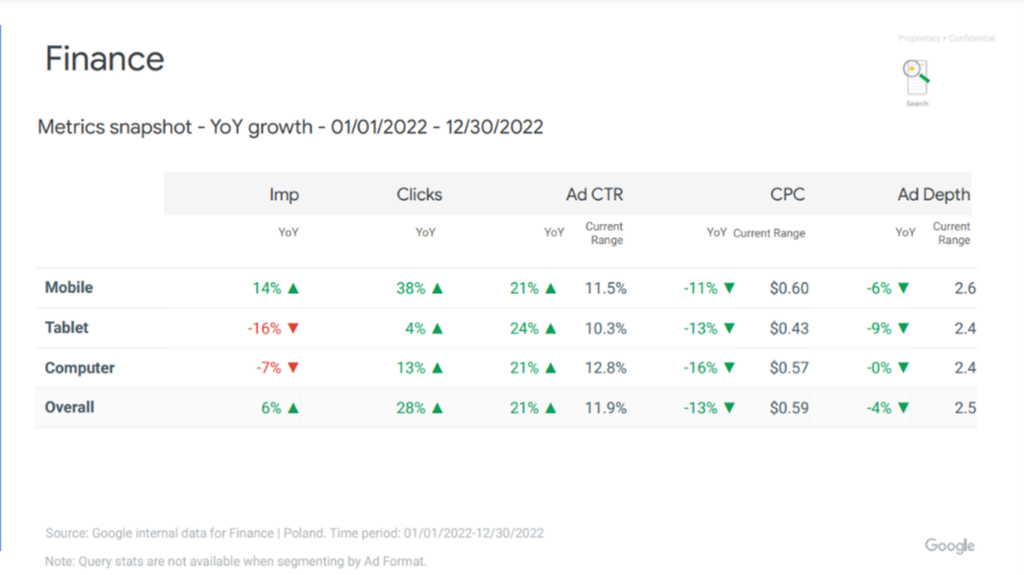

The financial industry is highly competitive, responding to the year-on-year increase in traffic potential with increases in banks' media spend on search network advertising:

A correspondingly higher budget was necessary to maintain the current level of visibility and y/y click-through growth. We regularly monitored auction analytics to ensure that ING Bank maintained the highest share of displays among its numerous competitors.

As a strategic partner, we supported ING Bank Slaski in understanding current client needs, monitoring the competition and prioritising promotions. To this end, we regularly prepared extensive analyses of the competition using popular tools such as Semrush, Similarweb, Ahrefs, Google's keyword planner, but also our own research (reviewing competitors' offers, in-house compilations, etc.). The resulting analyses included the competitor's current communications and the keywords and landing pages used by the competition, as well as the competitors' estimated budgets (based on estimates according to the auction analysis available in Google Ads). Conclusions and recommendations were then presented at bilateral ING-Bluerank meetings for further consideration on our Partner's side.

Implementation

AB testing and landing page optimisation

We systematically prioritised elements for A/B testing. On this basis, modified landing pages were created that guaranteed a higher CR rate. An example conclusion from the A/B test: for the Mobi account (accounts for young people, in Google Ads targeting 19-24 years old), a page that allows you to choose between two account types works better: Mobi (up to 26 years old) and Direct (over 26 years old). It is likely that the age group defined by Google is not accurate and does not allow for effective targeting. Similarly, for the +24 age group, targeting to a page showing all types of personal accounts, allowing a free choice of account type, works better.

Relevant communication

Consumer research commissioned by ING on savings, cyber security or investment planning. The data obtained enabled the bank to adapt its product offering and the agency's advertising message to current issues and the needs of society [1].

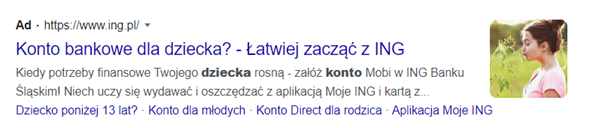

Example use: In the case of an offer aimed at parents seeking bank accounts for children and teenagers, the communication was tailored to the parent's needs defined in the research - learning to save and self-reliance:

In addition, for users defined by Google as parents of teenagers, we offered to open an adult account and an additional parental-controlled account for the teenager. Attracting young customers is strategically important for the bank. This is because the adult often stays with the bank previously chosen for him or her by the parent (if satisfied with its services). An attachment to the bank is formed at an early consumer stage, which pays off in later years.

Greater campaign reach through broad match

Seeking to extend the reach of the ads, we introduced separate campaigns with broad match [2], which were initially treated as a test, but through regular optimisation of these campaigns, we reached a level of CPA that decided to include these campaigns in ongoing activities.

Example: the cost of acquiring a user who opened a personal account in the broad match campaign was 23.79% lower than the average cost for all other generic campaigns. We excluded keywords used in the other campaigns from the campaign to avoid cannibalising them. The campaigns therefore displayed mainly for long-tail phrases.

Reducing wrong clicks

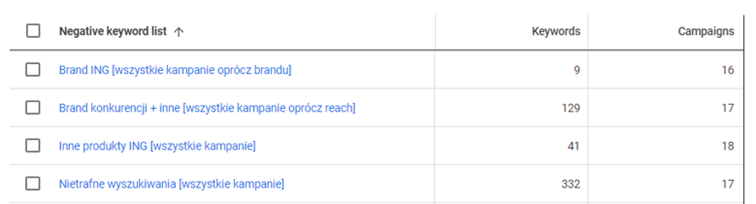

The introduction of shared keyword exclusion lists [3] was an improvement in optimisation and a necessary measure to reduce inappropriate clicks, counteract budget wastage and cannibalisation between products.

Example: ING mortgage loan

Common budget + smart bidding

A portfolio strategy, defining a common budget for multiple campaigns, is the canon of classic optimisation for many specialists. However, in an era of progressive campaign automation, it is worth going one step further. In the field of search network campaigns, we have used a combination of a common budget for multiple campaigns with a rate optimisation strategy common to these campaigns [4].

Thus, the management of the daily media budget for almost 100 campaigns was automated and CPA cost optimisation was more efficient, as it was carried out at the level of the entire account (1 account=1 separate bank product) rather than individual campaigns.

Scope of data used, including internal (via DMP)

In line with good optimisation practice, we have used dedicated audience lists in most of our campaigns to exclude or enhance targeting.

[1] Such forecasts and analyses are provided by ING Bank Slaski and are publicly available on the website: https://ekonomiczny.ing.pl/

[2] More on approximate keyword matching: https://support.google.com/google-ads/answer/2407779?hl=pl&ref_topic=24936&sjid=12075967124260950536-EU

[3] Check also: https://support.google.com/google-ads/answer/2453983?hl=pl&ref_topic=7450592&sjid=612053800665751678-EU

[4] https://support.google.com/google-ads/answer/11239164?hl=pl&ref_topic=10506627&sjid=612053800665751678-EU

Results

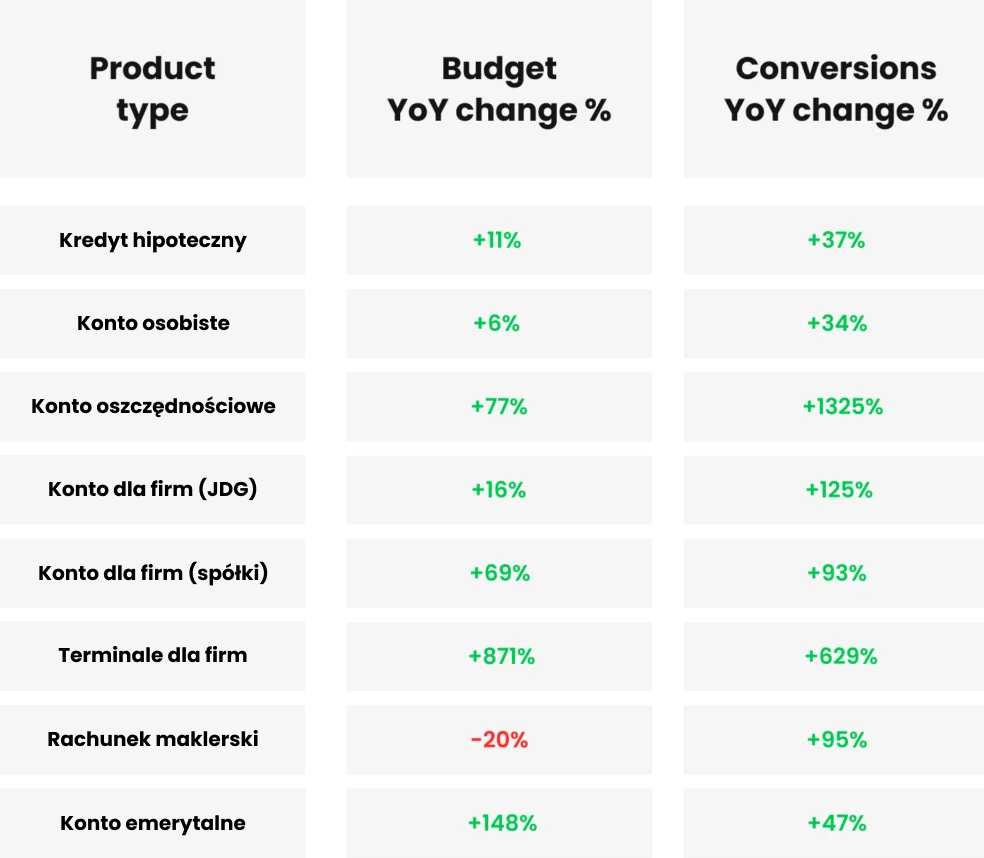

Growth of advertising budgets (% year-on-year)

Change in the number of clicks and CTR (% year-on-year)

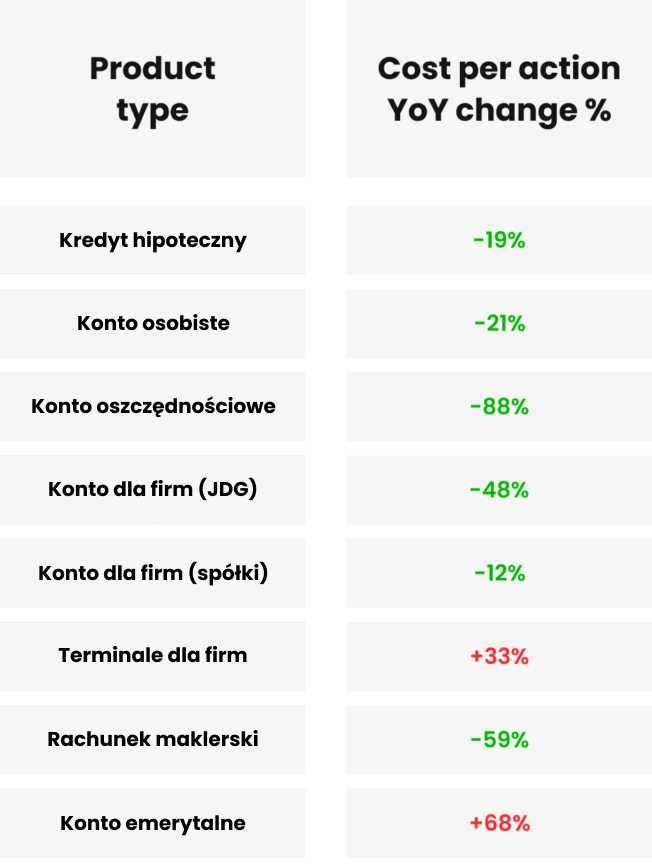

Optimisation of average conversion cost (% year-on-year)

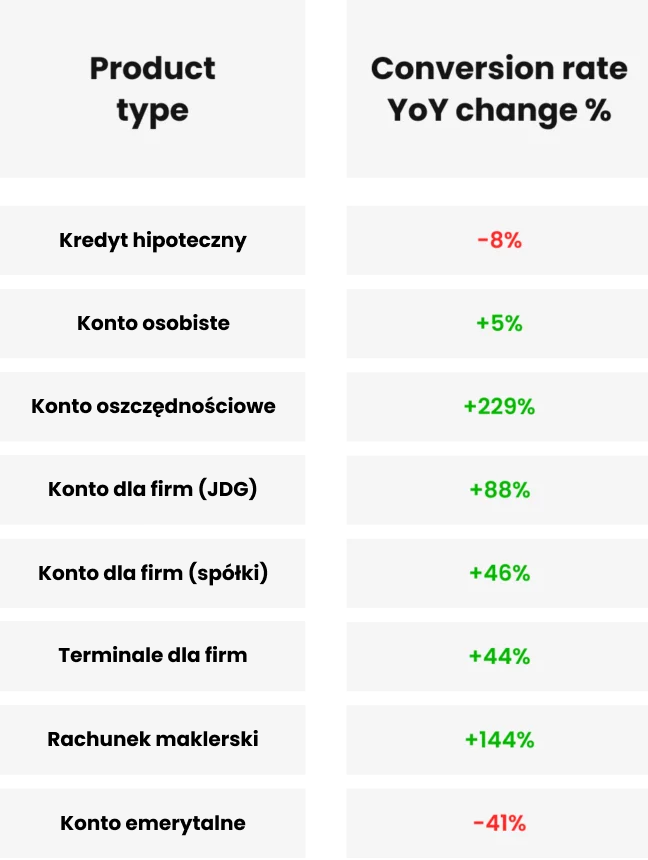

Conversion rate optimisation (% year-on-year)

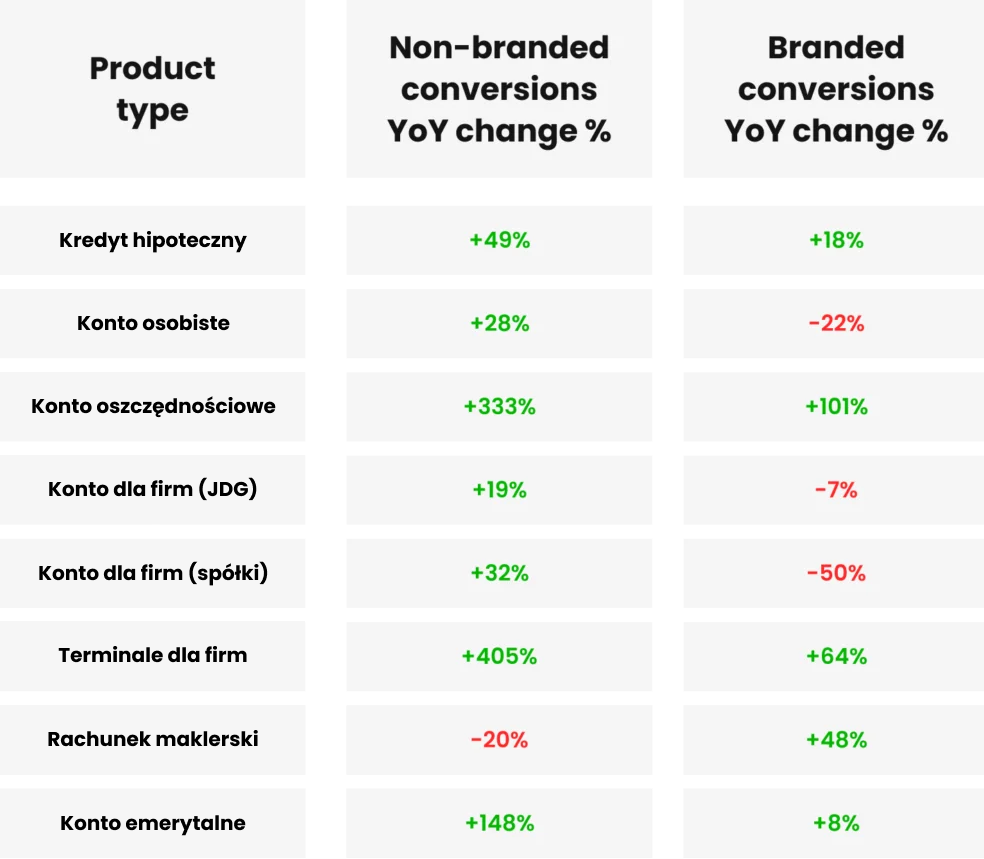

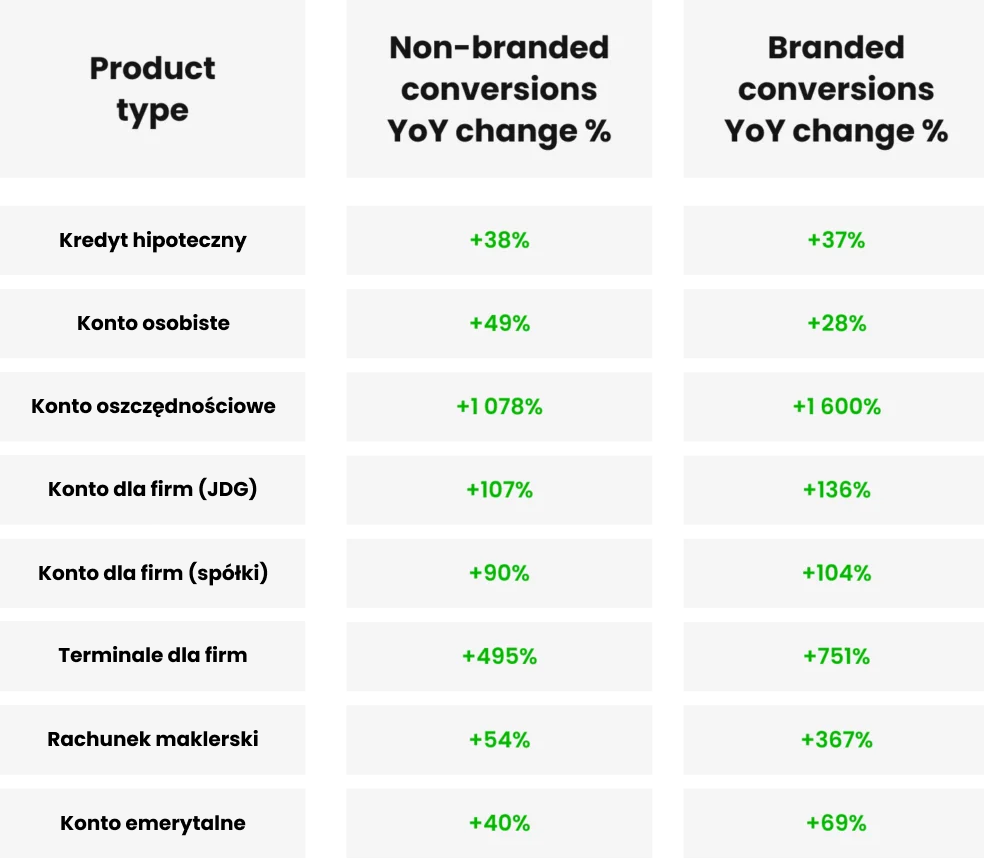

Increase in conversions by brand and generic campaigns:

Nominations

Projekt nominaed in European Search Awards 2023 in category: Best use of search (finance)

References

By combining Bluerank's expertise and specialisation with ING's experience, we achieved very good results, despite unfavourable macroeconomic conditions and consumer economic sentiment. This was achieved by combining effective media optimisations, implemented by the agency, with an empathetic focus on our clients' experiences based on our research and observations. Working together, we created relevant advertising messages and media strategy, which resulted in an increase in conversions gained from SEM, as well as a nomination for the European Search Awards, which we are very pleased and proud of.

Aneta Oratowska, Principal Expert in Digital Marketing, ING Bank Śląski